The individual coverage Health Reimbursement Arrangement (HRA) is an alternative to offering a traditional group health plan to your employees. It’s a specific account-based health plan that allows employers to provide defined non-taxed reimbursements to employees for qualified medical expenses, including monthly premiums and out-of-pocket costs, like copayments and deductibles.

Employees must be enrolled in individual health insurance coverage (like a plan they bought through the Marketplace) to use the funds.

Can I offer an individual coverage HRA?

Generally, employers of any size can offer an individual coverage HRA, as long as they have one employee who isn’t a self-employed owner or the spouse of a self-employed owner. HRAs are only for employees, not self-employed individuals.

Will I qualify for the Small Business Health Care Tax Credit?

Enrolling in Small Business Health Options Program (SHOP) coverage is generally the only way to qualify for the Small Business Health Care Tax Credit, which can save you up to 50% of your employer contribution for 2 consecutive years. Learn more about offering traditional group coverage SHOP plans to your employees.

How much can I contribute to my employees’ costs?

You have the flexibility to decide how much you contribute toward your employees’ individual coverage HRA for each 12-month plan year. There are no annual minimum or maximum contribution requirements.Begin highlighted text

IMPORTANT: Consider “affordability” when making an individual coverage HRA offer

Your individual coverage HRA offer may impact employees’ eligibility for premium tax credit that help lower monthly insurance payments through the Marketplace. The impact to employees depends on the affordability of your offer, which is based on your contribution, an employee’s household income, and the monthly premium of the self-only lowest cost Silver plan available to the employee through the Marketplace in their area.

Employees who are covered by an individual coverage HRA, or who are offered an affordable individual coverage HRA, can’t qualify for the premium tax credit.

These Marketplace tools help you in offering an individual coverage HRA:

- Employer affordability tool to determine the lowest cost Silver plans in your area (XLSM, 2.8 MB).

- HealthCare.gov HRA decision guide to enter some general information about your employees and your offer to see how it might affect them.

- Learn more about affordability rules for individual coverage HRAs.

End highlighted text

What’s considered an “affordable” individual coverage HRA offer?

An individual coverage HRA is considered affordable for an employee if the monthly premium the employee would pay (after the employer’s reimbursement) for the self-only lowest cost Silver plan available to them through the Marketplace in their area is less than 9.83% of 1/12 of the employee’s household income.

- If your offer is affordable: The employee won’t be eligible for the premium tax credit for the employee’s Marketplace coverage or the coverage of other household members who would be covered by the individual coverage HRA.

- If your offer isn’t affordable: The employee must decline (“opt out” of) the individual coverage HRA to claim the premium tax credit, if otherwise eligible, for the Marketplace coverage of the employee and household members with an individual coverage HRA offer. The employee can’t combine the individual coverage HRA with a premium tax credit.

How is “affordability” determined?

If applying for coverage through HealthCare.gov, employees will provide information about their individual coverage HRA offer when completing an application for Marketplace coverage, including the HRA’s start date and the contribution amount.

The Marketplace will determine if the offer meets requirements for “affordability,” which will help determine an employee’s eligibility for premium tax credit. Prior to submitting a Marketplace application, employees can also use the HRA tool for an estimate of their individual coverage HRA’s affordability.

Can my employees use pre-tax dollars to pay the portion of the health plan premiums not covered by an individual coverage HRA?

You may use a salary reduction arrangement under a cafeteria plan to allow your employees to pay on a pre-tax basis the portion of the individual health insurance premiums not covered by your individual coverage HRA.

However, your employees can’t use these pre-tax payments to pay for Marketplace coverage. They can still use the individual coverage HRA to buy individual health insurance coverage, but they’ll need to purchase coverage off the Marketplace to use the individual coverage HRA and make salary reduction contributions using a cafeteria plan.

Which employees are eligible for my individual coverage HRA offer?

You can offer an individual coverage HRA to any eligible employee, or you can offer it only to certain types of your employees. The types or classes of employees can be determined by certain job-based criteria, like:

- Full-time, part-time, or seasonal status

- Employees covered by a collective bargaining agreement

- Salaried or non-salaried (like hourly workers) employees

- Employees who haven’t satisfied a waiting period

- Non-resident aliens with no U.S.-based income

- Employee work locations

- Any combination of 2 or more employee types listed above

The individual coverage HRA rules specify the classes. You can’t make up your own classes. Find a full list of available classes (PDF, 408 KB).

The reimbursement amount you offer can also vary within each employee class based on age (not to exceed a 3:1 ratio) or number of dependents, and you can set a waiting period for new employees. There’s also a special rule for new hires. Otherwise, you must offer the individual coverage HRA on the same terms to all employees in a class.

Can I offer an individual coverage HRA with traditional group coverage?

You can offer certain types of employees a traditional group health plan and other types of employees an individual coverage HRA. But you can’t offer the same type of employees a choice between a traditional group health plan and an individual coverage HRA. For example, you can offer full-time employees a traditional group health plan and part-time employees an individual coverage HRA.

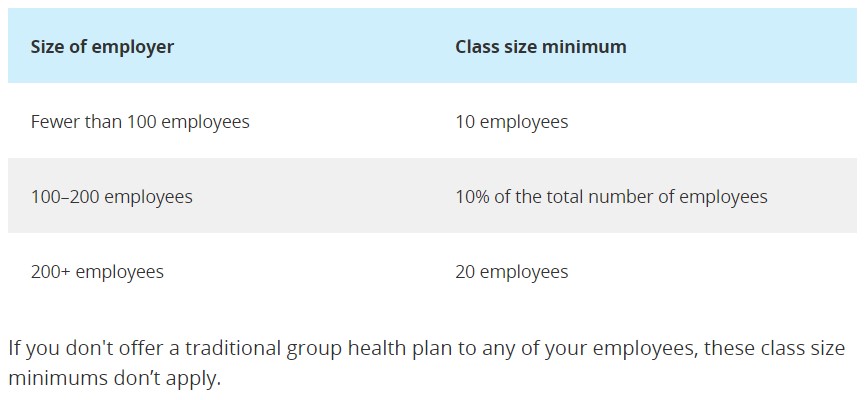

There are certain requirements if you offer an individual coverage HRA to one type of employee and traditional group health plan coverage to another type of employee. If you offer an individual coverage HRA only to certain employees, in some cases, there are size requirements for certain classes of employees that get an individual coverage HRA offer:

How to start an individual coverage HRA

You can set up an individual coverage HRA at any time. You’ll need to provide a written notice to your employees as soon as they’re eligible to participate and 90 days before the beginning of each plan year.

Employees will need information from this notice to fill out a Marketplace application and check eligibility for a premium tax credit on a Marketplace health plan, or free or low-cost coverage through Medicaid or the Children’s Health Insurance Program (CHIP). They must be offered the chance to decline (“opt out” of) the individual coverage HRA before the plan year begins.

See a sample HRA notice to learn what information employers must include. (PDF, 93 KB).

Remember, to use their individual coverage HRA amount, employees must be enrolled in individual health insurance coverage, like a plan purchased through the Marketplace or from a private insurance company, or have Medicare coverage (Part A and Part B, or Part C).

Short-term plans, or other limited benefits coverage, like dental or vision insurance, don’t meet this requirement (PDF, 408 KB). There must be reasonable procedures in place (PDF, 70 KB) to confirm that employees and their households covered by the individual coverage HRA are enrolled in individual health insurance coverage.

You should consider how your employees can get individual health insurance coverage when picking a start date. For example, offering an individual coverage HRA starting on January 1 allows employees to choose coverage during the individual market’s annual Open Enrollment Period, and in most cases, plan deductibles reset on January 1 each year.

If you’re ending a traditional group health plan to offer an individual coverage HRA, or a class of employees is offered a new individual coverage HRA, your employees may qualify for a Special Enrollment Period. To enroll in or change coverage through this Special Enrollment Period, employees can submit an application on HealthCare.gov and include information about when their HRA can start.

Generally, employees will need to submit an application and select a plan in time for it to take effect by the first day that their individual coverage HRA can start.

Need help deciding whether an individual coverage HRA is right for your business?

Find Local Help. Search for a registered agent/broker, or trained assister in your area. You may also want to talk with a licensed tax professional or benefits specialist.

Compare coverage options with our HRA decision guide. Find out more about how an individual coverage HRA compares to other products and services that may be available to help you cover your employees.

Employees: Understanding individual coverage HRAs

If you’re an employee who has been offered an individual coverage HRA by your employer, learn more about individual coverage HRAs and the Marketplace.